-

- Art. 3 FC

- Art. 5a FC

- Art. 6 FC

- Art. 10 FC

- Art. 13 FC

- Art. 16 FC

- Art. 17 FC

- Art. 20 FC

- Art. 22 FC

- Art. 26 FC

- Art. 29a FC

- Art. 30 FC

- Art. 31 FC

- Art. 32 FC

- Art. 42 FC

- Art. 43 FC

- Art. 43a FC

- Art. 45 FC

- Art. 55 FC

- Art. 56 FC

- Art. 60 FC

- Art. 68 FC

- Art. 74 FC

- Art. 75b FC

- Art. 77 FC

- Art. 81 FC

- Art. 96 para. 1 FC

- Art. 96 para. 2 lit. a FC

- Art. 110 FC

- Art. 117a FC

- Art. 118 FC

- Art. 123a FC

- Art. 123b FC

- Art. 130 FC

- Art. 136 FC

- Art. 164 FC

- Art. 166 FC

- Art. 170 FC

- Art. 178 FC

- Art. 189 FC

- Art. 191 FC

-

- Art. 11 CO

- Art. 12 CO

- Art. 50 CO

- Art. 51 CO

- Art. 84 CO

- Art. 97 CO

- Art. 98 CO

- Art. 99 CO

- Art. 100 CO

- Art. 143 CO

- Art. 144 CO

- Art. 145 CO

- Art. 146 CO

- Art. 147 CO

- Art. 148 CO

- Art. 149 CO

- Art. 150 CO

- Art. 633 CO

- Art. 701 CO

- Art. 715 CO

- Art. 715a CO

- Art. 734f CO

- Art. 785 CO

- Art. 786 CO

- Art. 787 CO

- Art. 788 CO

- Art. 808c CO

- Transitional provisions to the revision of the Stock Corporation Act of June 19, 2020

-

- Art. 2 PRA

- Art. 3 PRA

- Art. 4 PRA

- Art. 6 PRA

- Art. 10 PRA

- Art. 10a PRA

- Art. 11 PRA

- Art. 12 PRA

- Art. 13 PRA

- Art. 14 PRA

- Art. 15 PRA

- Art. 16 PRA

- Art. 17 PRA

- Art. 19 PRA

- Art. 20 PRA

- Art. 21 PRA

- Art. 22 PRA

- Art. 23 PRA

- Art. 24 PRA

- Art. 25 PRA

- Art. 26 PRA

- Art. 27 PRA

- Art. 29 PRA

- Art. 30 PRA

- Art. 31 PRA

- Art. 32 PRA

- Art. 32a PRA

- Art. 33 PRA

- Art. 34 PRA

- Art. 35 PRA

- Art. 36 PRA

- Art. 37 PRA

- Art. 38 PRA

- Art. 39 PRA

- Art. 40 PRA

- Art. 41 PRA

- Art. 42 PRA

- Art. 43 PRA

- Art. 44 PRA

- Art. 45 PRA

- Art. 46 PRA

- Art. 47 PRA

- Art. 48 PRA

- Art. 49 PRA

- Art. 50 PRA

- Art. 51 PRA

- Art. 52 PRA

- Art. 53 PRA

- Art. 54 PRA

- Art. 55 PRA

- Art. 56 PRA

- Art. 57 PRA

- Art. 58 PRA

- Art. 59a PRA

- Art. 59b PRA

- Art. 59c PRA

- Art. 60 PRA

- Art. 60a PRA

- Art. 62 PRA

- Art. 63 PRA

- Art. 64 PRA

- Art. 67 PRA

- Art. 67a PRA

- Art. 67b PRA

- Art. 73 PRA

- Art. 73a PRA

- Art. 75 PRA

- Art. 75a PRA

- Art. 76 PRA

- Art. 76a PRA

- Art. 90 PRA

-

- Art. 1 IMAC

- Art. 1a IMAC

- Art. 3 para. 1 and 2 IMAC

- Art. 8 IMAC

- Art. 8a IMAC

- Art. 11b IMAC

- Art. 16 IMAC

- Art. 17 IMAC

- Art. 17a IMAC

- Art. 32 IMAC

- Art. 35 IMAC

- Art. 47 IMAC

- Art. 63 IMAC

- Art. 67 IMAC

- Art. 67a IMAC

- Art. 74 IMAC

- Art. 74a IMAC

- Art. 80 IMAC

- Art. 80a IMAC

- Art. 80b IMAC

- Art. 80c IMAC

- Art. 80d IMAC

- Art. 80h IMAC

-

- Vorb. zu Art. 1 FADP

- Art. 1 FADP

- Art. 2 FADP

- Art. 3 FADP

- Art. 4 FADP

- Art. 5 lit. c FADP

- Art. 5 lit. d FADP

- Art. 5 lit. f und g FADP

- Art. 6 para. 3-5 FADP

- Art. 6 Abs. 6 and 7 FADP

- Art. 7 FADP

- Art. 10 FADP

- Art. 11 FADP

- Art. 12 FADP

- Art. 14 FADP

- Art. 15 FADP

- Art. 18 FADP

- Art. 19 FADP

- Art. 20 FADP

- Art. 22 FADP

- Art. 23 FADP

- Art. 25 FADP

- Art. 26 FADP

- Art. 27 FADP

- Art. 31 para. 2 lit. e FADP

- Art. 33 FADP

- Art. 34 FADP

- Art. 35 FADP

- Art. 38 FADP

- Art. 39 FADP

- Art. 40 FADP

- Art. 41 FADP

- Art. 42 FADP

- Art. 43 FADP

- Art. 44 FADP

- Art. 44a FADP

- Art. 45 FADP

- Art. 46 FADP

- Art. 47 FADP

- Art. 47a FADP

- Art. 48 FADP

- Art. 49 FADP

- Art. 50 FADP

- Art. 51 FADP

- Art. 52 FADP

- Art. 54 FADP

- Art. 55 FADP

- Art. 57 FADP

- Art. 58 FADP

- Art. 60 FADP

- Art. 61 FADP

- Art. 62 FADP

- Art. 63 FADP

- Art. 64 FADP

- Art. 65 FADP

- Art. 66 FADP

- Art. 67 FADP

- Art. 69 FADP

- Art. 72 FADP

- Art. 72a FADP

-

- Art. 2 CCC (Convention on Cybercrime)

- Art. 3 CCC (Convention on Cybercrime)

- Art. 4 CCC (Convention on Cybercrime)

- Art. 5 CCC (Convention on Cybercrime)

- Art. 6 CCC (Convention on Cybercrime)

- Art. 7 CCC (Convention on Cybercrime)

- Art. 8 CCC (Convention on Cybercrime)

- Art. 9 CCC (Convention on Cybercrime)

- Art. 11 CCC (Convention on Cybercrime)

- Art. 12 CCC (Convention on Cybercrime)

- Art. 16 CCC (Convention on Cybercrime)

- Art. 18 CCC (Convention on Cybercrime)

- Art. 25 CCC (Convention on Cybercrime)

- Art. 27 CCC (Convention on Cybercrime)

- Art. 28 CCC (Convention on Cybercrime)

- Art. 29 CCC (Convention on Cybercrime)

- Art. 32 CCC (Convention on Cybercrime)

- Art. 33 CCC (Convention on Cybercrime)

- Art. 34 CCC (Convention on Cybercrime)

-

- Art. 2 para. 1 AMLA

- Art. 2a para. 1-2 and 4-5 AMLA

- Art. 2 para. 3 AMLA

- Art. 3 AMLA

- Art. 7 AMLA

- Art. 7a AMLA

- Art. 8 AMLA

- Art. 8a AMLA

- Art. 11 AMLA

- Art. 14 AMLA

- Art. 15 AMLA

- Art. 20 AMLA

- Art. 23 AMLA

- Art. 24 AMLA

- Art. 24a AMLA

- Art. 25 AMLA

- Art. 26 AMLA

- Art. 26a AMLA

- Art. 27 AMLA

- Art. 28 AMLA

- Art. 29 AMLA

- Art. 29a AMLA

- Art. 29b AMLA

- Art. 30 AMLA

- Art. 31 AMLA

- Art. 31a AMLA

- Art. 32 AMLA

- Art. 38 AMLA

FEDERAL CONSTITUTION

MEDICAL DEVICES ORDINANCE

CODE OF OBLIGATIONS

FEDERAL LAW ON PRIVATE INTERNATIONAL LAW

LUGANO CONVENTION

CODE OF CRIMINAL PROCEDURE

CIVIL PROCEDURE CODE

FEDERAL ACT ON POLITICAL RIGHTS

CIVIL CODE

FEDERAL ACT ON CARTELS AND OTHER RESTRAINTS OF COMPETITION

FEDERAL ACT ON INTERNATIONAL MUTUAL ASSISTANCE IN CRIMINAL MATTERS

DEBT ENFORCEMENT AND BANKRUPTCY ACT

FEDERAL ACT ON DATA PROTECTION

CRIMINAL CODE

CYBERCRIME CONVENTION

COMMERCIAL REGISTER ORDINANCE

FEDERAL ACT ON COMBATING MONEY LAUNDERING AND TERRORIST FINANCING

FREEDOM OF INFORMATION ACT

FEDERAL ACT ON THE INTERNATIONAL TRANSFER OF CULTURAL PROPERTY

- I. Introduction

- II. Scope of application and legal nature

- III. Proportional reduction

- Bibliography

- Materials

I. Introduction

1 According to Art. 523 of the CC, acquisitions by “heirs entitled to a compulsory portion” in accordance with the statutory succession and gifts mortis causa shall be reduced in proportion to the amounts exceeding their compulsory portion. While a person entitled to a compulsory portion can only demand the reduction of acquisitions or gifts from persons entitled to inherit or bequeathed persons if they have “received less than their compulsory portion in terms of value” (Art. 522 para. 1 of the Swiss CC), acquisitions or gifts from persons entitled to a compulsory portion can only be reduced to the extent that they exceed their compulsory portion. Art. 523 CC thus stipulates, on the one hand, that the maximum amount that can be reduced for persons entitled to a compulsory portion is that which “exceeds their compulsory portion.” On the other hand, Art. 523 CC contains a “principle of equal treatment,” according to which acquisitions or gifts made by persons entitled to a compulsory portion must in principle (cf. N. 5) be reduced proportionally, i.e., in proportion to the amounts exceeding the compulsory portions (cf. N. 8).

II. Scope of application and legal nature

A. Scope of application

2 While Art. 525 para. 1 CC regulates the reduction of gifts mortis causa to several “appointed heirs and beneficiaries,” Art. 523 CC refers to gifts mortis causa and acquisitions in accordance with the legal succession in favor of “heirs entitled to a compulsory portion.” Art. 523 CC also applies analogously to lifetime gifts made simultaneously to persons entitled to a compulsory portion.

3 It should be noted that acquisitions in accordance with the statutory succession (so-called “intestate succession”) in favor of persons entitled to a compulsory portion must be reduced in accordance with the order of reduction pursuant to Art. 532 CC before gifts mortis causa (so-called “testamentary succession”) – as well as before (simultaneous) lifetime gifts – in favor of persons entitled to a compulsory portion. The principle of proportional reduction pursuant to Art. 523 of the CC therefore applies separately to each “reduction level” of Art. 532 of the CC. This means that the reduction limit, i.e., the maximum amount that can be reduced for persons entitled to a compulsory portion on the basis of their own compulsory portion (see N. 8), – and accordingly also the reduction rate and the individual reduction amount (see N. 10) – must be determined separately at each reduction level (cf. Example 2 under N. 13 and Example 4 under N. 15). However, according to the opinion expressed here, the reduction limit (cf. N. 8) only applies at the reduction level within the meaning of Art. 532 CC at which the reduction affects the person's own compulsory portion (cf. N. 9).

4 If gifts to persons entitled to a compulsory portion as well as to other (non-entitled) persons are to be reduced, the literature refers to a “combination” of Art. 523 CC and Art. 525 para. 1 CC. Apart from the subjective scope of application (cf. N. 2) and the explicit reservation of deviation in Art. 525 para. 1 CC (cf. N. 6), the only material difference between Art. 523 and Art. 525 para. 1 CC is that the corresponding reduction limits must be taken into account when calculating the reduction rate for persons entitled to a compulsory portion. This means that the reduction limit (cf. N. 8) for beneficiaries within the meaning of Art. 525 para. 1 CC is limited solely by the gift (at a certain reduction level) and not additionally by a compulsory portion amount.

B. Legal nature

5 Art. 523 of the Swiss CC (CC) is a dispositive right. The testator may therefore deviate from the proportional reduction of acquisitions or gifts to persons entitled to a compulsory portion. However, it is not possible to deviate from the principle that only the amount exceeding the compulsory portion may be reduced. Any provision to the contrary would violate the right to a compulsory portion and would be reducible accordingly. However, if the testator exempts certain persons entitled to inherit or bequeathed from the (proportional) reduction, the question arises as to whether the testator can thereby indirectly influence the order of reduction in accordance with Art. 532 of the Swiss CC. Since Art. 532 of the Swiss CC is (at least largely) mandatory law, this question must be rejected – in accordance with the opinion expressed here – if a deviation from the proportional deviation results in an ‘impermissible’ (or reducible) change in the order of reduction. A deviation or exemption from the proportional reduction is therefore only possible at a certain reduction level and cannot result in a certain acquisition or gift at a certain reduction level being “skipped” – in whole or in part – at the expense of an acquisition or gift at a subsequent reduction level.

6 This raises the question of the form in which such a deviation from proportional reduction must be recorded. When reducing gifts mortis causa in favor of persons entitled to a compulsory portion, it is obvious to apply Art. 525 para. 1 of the Swiss CC (CC) analogously, according to which “a different intention of the testator” must be “apparent” from the disposition. The testator's intention to deviate from the proportional reduction does not have to be expressly stated in the disposition of property upon death, but must be ascertainable by means of interpretation.

7 The question then arises as to (a) whether a deviation from the proportional reduction contained in a disposition of property upon death also applies to the reduction of acquisitions in accordance with the statutory succession and (simultaneous) lifetime gifts, and (b) whether such a deviation with regard to the reduction of (simultaneous) lifetime gifts can also take a form that does not comply with the provisions of Art. 498 ff. of the CC. The first question must be answered by interpreting the disposition of property upon death, in accordance with the opinion expressed here. If it is expressed therein that the testator generally wished to deviate from the reduction method within the meaning of Art. 523 of the Swiss Civil Code (CC) – subject to the restrictions mentioned under N. 5 – this applies, in our opinion, to every reduction level within the meaning of Art. 532 of the Swiss Civil Code (CC). For the second question, an analogous application of the case law on the form of a waiver of equalization within the meaning of Art. 626 para. 2 of the Swiss CC could be considered. However, due to the associated uncertainty, it is advisable to record the deviation from the proportional reduction by means of a disposition of property upon death.

III. Proportional reduction

A. Calculation method

8 Pursuant to Art. 523 of the CC, the reduction is made in proportion to the amounts exceeding the compulsory portions (“proportional reduction”). Accordingly, if there are several defendants in the reduction proceedings (or persons against whom the reduction objection is raised), the maximum amount that could be reduced (“reduction limit”) must be determined at each reduction level (see N. 3). For persons who are not entitled to a compulsory portion, this corresponds to the total gift (cf. Art. 525 para. 1 of the Swiss CC). For persons entitled to a compulsory portion, the reduction limit generally corresponds to the difference between (a) their own acquisitions or gifts and (b) their own compulsory portion.

9 If the person entitled to a compulsory portion has received their acquisitions or gifts at different reduction levels (within the meaning of Art. 532 of the Swiss CC), it is questionable at which reduction level they have received them. gifts at different reduction levels (within the meaning of Art. 532 CC), it is questionable at which reduction level (within the meaning of Art. 532 CC) the reduction limit (pursuant to Art. 523 CC) applies. The question here is whether the compulsory portion protection of the person with passive legitimacy (and entitled to a compulsory portion) (a) only applies at the reduction level at which the reduction affects their own compulsory portion (“Thesis 1”), or (b) already applies at the “first” reduction level at which the person with passive legitimacy is confronted with the reduction (“Thesis 2”). Even though convincing arguments can be made for both theses, “Thesis 2” conflicts to a certain extent with the (at least largely) mandatory reduction order of Art. 532 CC (see N. 5), which is why “Thesis 1” deserves preference. According to the opinion expressed here, Art. 523 CC merely clarifies in this regard that the person with passive legitimacy (entitled to a compulsory portion) does not have to accept a reduction that would ultimately result in them receiving less than their compulsory portion. As long as the reduction at a certain reduction level does not lead to such an encroachment on the compulsory portion, the person with passive legitimacy cannot – in contrast to “Thesis 2” – object that only the amount exceeding their compulsory portion should be reduced. According to the opinion expressed here (in line with “Thesis 1”), the reduction limit therefore only applies once the reduction at a reduction level affects the person's own compulsory portion (see Example 2 under N. 13). Since, as far as can be seen, there is currently neither a prevailing opinion nor established case law on this issue, there is considerable legal uncertainty in this regard. In such cases, the person whose compulsory portion has been infringed should therefore not rely on the reduction defense (cf. Art. 533 CC), because it can be assumed that the person with passive legitimacy will represent “Thesis 2,” and this may mean that the compulsory portion cannot be restored by way of defense.

10 Once the reduction limits (“L”) of the defendants (or persons affected by the reduction defense) have been determined in a first step at the relevant reduction level (see N. 9), the total reduction limits (“T”) must be determined in a second step. In a third step, the individual reduction limits (“L”) must then be set in relation to the aforementioned total reduction limits (‘T’), which results in the individual reduction quotas (“Q”). If the reduction amount, i.e. the amount required to restore the compulsory portion of the reduction claimant (or the person raising the reduction objection) (“B”), can be covered at the reduction level in question, these reduction quotas (‘Q’) must be multiplied by the reduction amount (“B”) in a fourth step. Otherwise, i.e. if the reduction amount (“B”) cannot be covered at the reduction level in question, the reduction rates (‘Q’) must be multiplied by the total reduction limits (“T”). This results in the individual reduction amount (“H”) for the recipient of the grant at a specific reduction level. The formula is therefore “H = (L / T) x B”, whereby – as mentioned – ‘B’ may correspond to “T” under certain circumstances, i.e. if the reduction amount can be covered at the relevant reduction level (see examples 1-4 under N. 12-15).

11 In cases where a usufruct has been ordered within the meaning of Art. 473 of the Swiss CC, the literature suggests that the value of the compulsory portion should be calculated on the basis of the compulsory portion that would have existed if the surviving spouse had opted for his or her inheritance share (and corresponding ownership) instead of the corresponding usufructuary legacy. In our opinion, this suggestion is irrelevant insofar as the compulsory portion of the surviving spouse and descendants exists regardless of whether the spouse opted for the usufructuary legacy or – in accordance with a corresponding right of choice or by applying the “biens aisément négociables” doctrine – for the inheritance or ownership. Even if the surviving spouse has opted for the usufructuary legacy, the compulsory portion of the surviving spouse is calculated as of the date of death without taking the usufructuary legacy into account. The joint descendants must accept such usufruct in favor of the surviving spouse, even if the value of the “bare ownership” is less than the compulsory portion. However, this does not mean that the descendants in such constellations have no compulsory portion, which can be claimed as a reduction limit within the framework of Art. 523 of the CC.

B. Calculation examples

1. Reduction at the expense of persons entitled to a compulsory portion (Art. 523 CC)

a. Gifts at the same reduction level

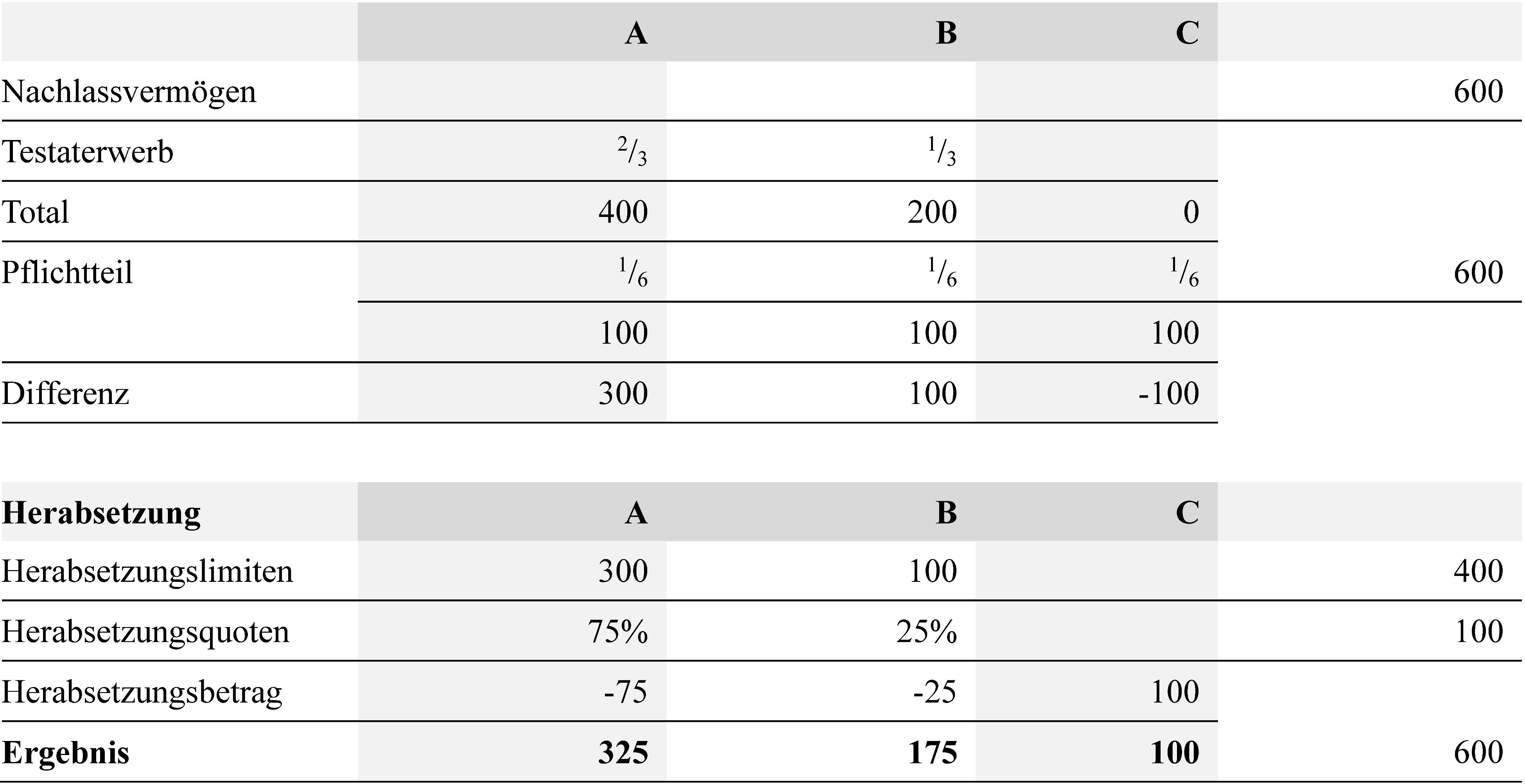

12 Example 1: The testator “E” leaves behind a net estate of 600, his three descendants “A,” “B,” and “C,” and a will in which he appoints A as heir with a share of 2/3 and B as heir with a share of 1/3. A's share of the inheritance is 400 (2/3 of 600), B's is 200 (1/3 of 600) and C's is 0. The descendants' compulsory portions are 100 each (1/6 of 600). C's compulsory portion is therefore violated by 100. The reduction limit for A is 300 (testamentary acquisition of 400 minus compulsory portion of 100) and that for B is 100 (testamentary acquisition of 200 minus compulsory portion of 100). The total reduction limits amount to 400 (300 from A plus 100 from B). The reduction rate is 75% for A (300 in relation to 400) and 25% for B (100 in relation to 400). At the reduction level of the testamentary acquisition, the inheritance of A is reduced by 75 (75% of 100) and that of B by 25 (25% of 100). As a result, A receives 325, B 175, and C 100.

b. Gifts at different reduction levels

b. Gifts at different reduction levels

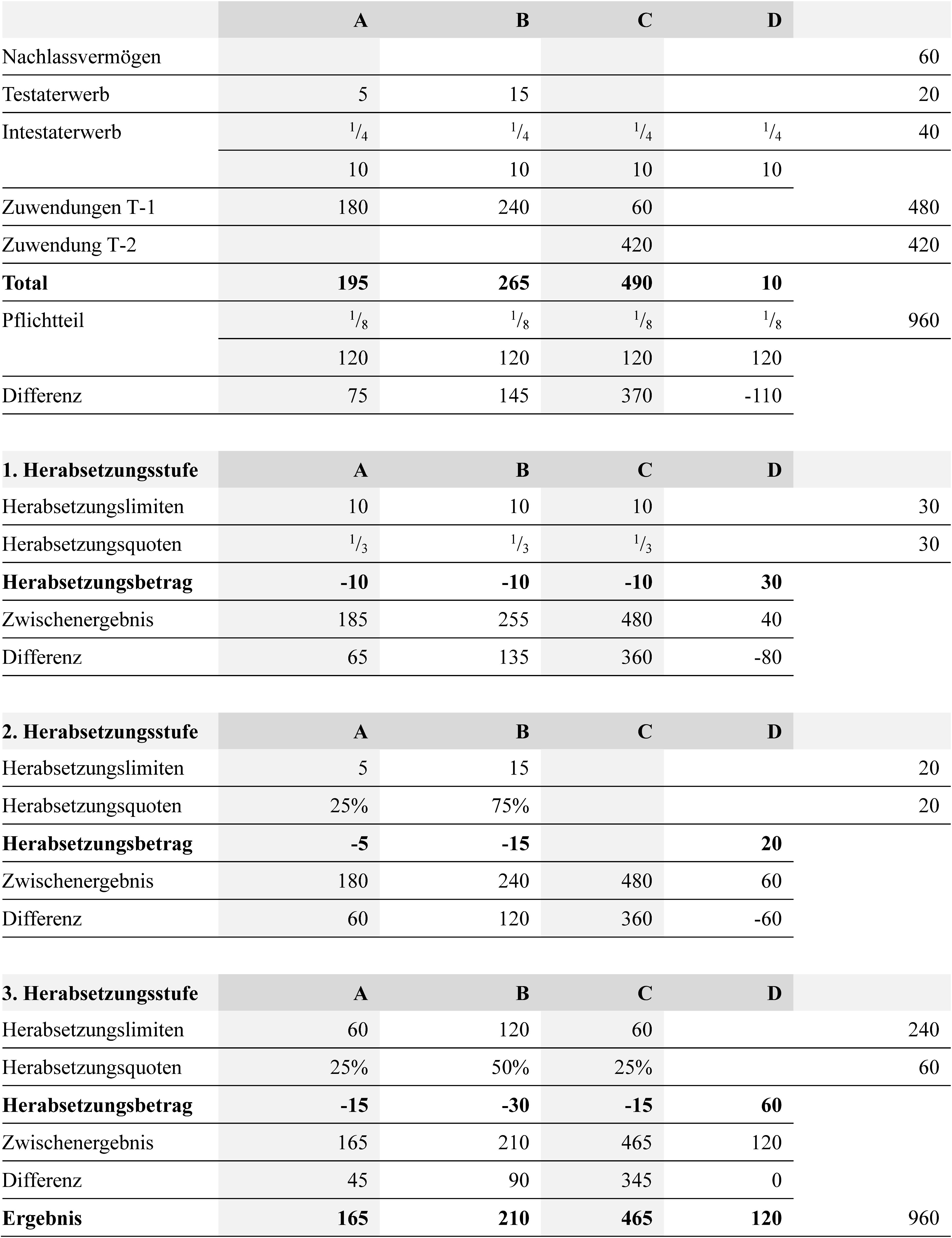

13 Example 2: The testator “E” leaves behind a net estate of 60, a will (with bequests), and his four descendants “A,” “B,” “C,” and “D.” Two years before his death, E – with a compensation exemption – gifted 420 to C (“gift T-2”). One year before his death, E – at the same time and in each case with a compensation exemption – gifted 180 to A, 240 to B and 60 to C (“gifts T-1”) . The will contains a bequest of 5 to A and a bequest of 15 to B. The estate is worth 40, the compulsory portion calculation base (“PTBM”) is 960, the inheritance shares are 10 each, and the compulsory portions are 120 each (1/8 of 960). In total (without reduction), A would therefore receive 195, B 265, C 490, and D 10. D's compulsory portion is violated by 110. At the reduction stage of intestate succession (“1st reduction stage”), the inheritance shares of A, B, and C are therefore reduced by 10 each. This means that D's compulsory portion is still violated by 80. At the reduction level of testamentary acquisition (“2nd reduction level”), A's legacy is reduced by 5 and B's legacy by 15. This means that D's compulsory portion is still violated by 60. At the reduction level for (more recent or most recent) lifetime gifts (“3rd reduction level”), the reduction limit is 60 for A, 120 for B, and 60 for C; the reduction limit of Art. 523 of the Swiss CC applies to A and B (see calculation overview below). The total reduction limit is 240. The reduction rate is 25% for A and C (60 in relation to 240) and 50% for B (120 in relation to 240). Accordingly, the lifetime gifts from A and C are reduced by 15 (25% of 60) and those from B by 30 (50% of 60). As a result, A receives 165, B 210, C 465, and D 120.

2. Reduction at the expense of persons entitled to a compulsory portion and other persons (Art. 523 in conjunction with Art. 525 para. 1 of the Swiss CC)

2. Reduction at the expense of persons entitled to a compulsory portion and other persons (Art. 523 in conjunction with Art. 525 para. 1 of the Swiss CC)

a. Gifts at the same reduction level

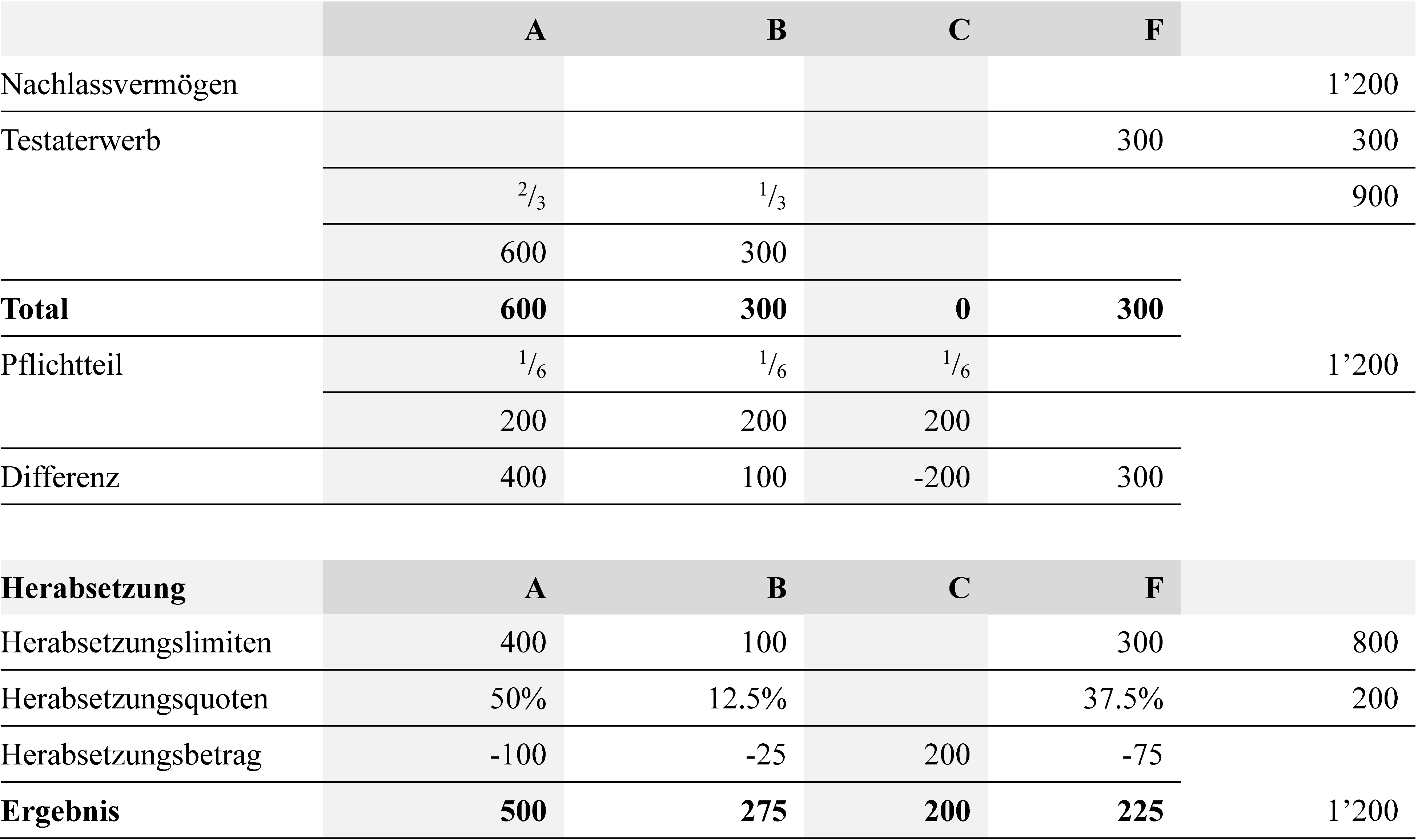

14 Example 3: The testator “E” leaves behind a net estate of 1200, his three descendants “A,” “B,” and “C,” and a will in which he appoints A as heir with a share of 2/3 and B as heir with a share of 1/3, and also bequeaths 300 to his girlfriend “F.” The estate is worth $900, the PTBM is $1,200, and the compulsory portions of the descendants are $200 each (1/6 of $1,200). A's share of the inheritance is 600, B's share is 300. C's compulsory portion is therefore violated by 200. The reduction limit for A is 400, for B 100, and for F 300. The total reduction limit is 800. The reduction rate is 50% for A (400 in relation to 800), 12.5% for B (100 in relation to 800), and 37.5% for F (300 in relation to 800). At the reduction stage of the acquisition of the certificate, the inheritance of A is reduced by 100 (50% of 200), that of B by 25 (12.5% of 200) and the bequest of F by 75 (37.5% of 200). As a result, A receives 500, B 275, C 200, and F 225.

b. Gifts at different reduction levels

b. Gifts at different reduction levels

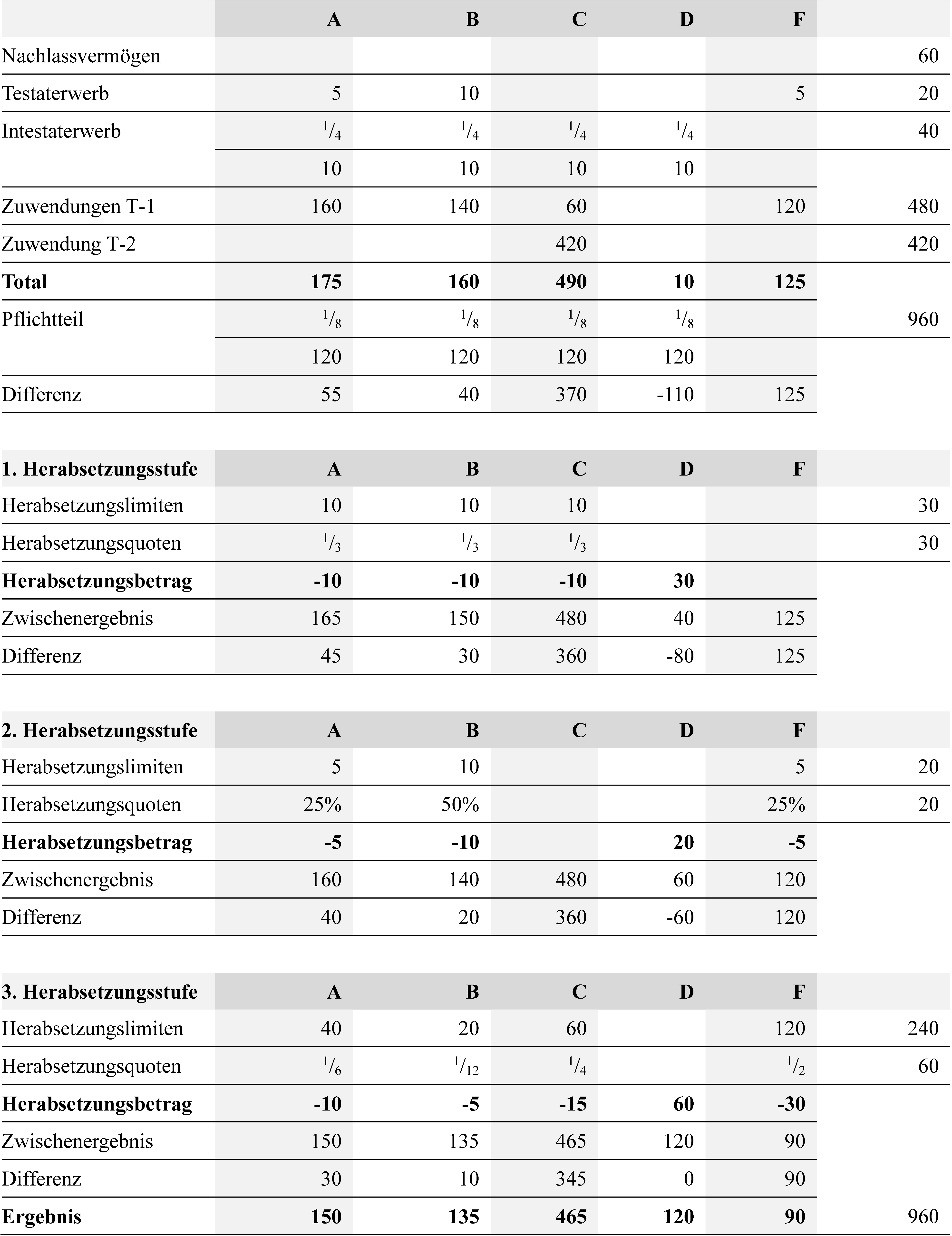

15 Example 4: The testator “E” leaves behind a net estate of 60, a will (with bequests), his four descendants “A,” “B,” “C,” and “D,” and his girlfriend “F.” Two years before his death, E gave C a gift of 420 (gift T-2), again with a waiver of equalization. One year before his death, E gave 160 to A, 140 to B, 60 to C, and 120 to F (“gifts T-1”), each at the same time and with a compensation exemption. The will contains a bequest of 5 to A, a bequest of 10 to B, and a bequest of 5 to F. The estate is worth 40, the compulsory portion calculation base (“PTBM”) is 960, the inheritance shares are 10 each, and the compulsory portions are 120 each (1/8 of 960). In total (without reduction), A would therefore receive 175, B 160, C 490, D 10, and F 125. D's compulsory portion is violated by 110. At the reduction stage of intestate succession, the inheritance shares of A, B, and C are reduced by 10 each. This means that D's compulsory portion is still violated by 80. At the reduction stage of testamentary succession, A's bequest is reduced by 5, B's bequest by 10, and F's bequest by 5. This means that D's compulsory portion is still infringed by 60. At the reduction level of the (more recent or most recent) lifetime gift, the reduction limit for A is 40, for B 20, for C 60, and for F 120. The total reduction limit is 240. The reduction rate is 1/6 (40 in relation to 240) for A, 1/12 (20 in relation to 240) for B, 25% (60 in relation to 240) for C, and 50% (120 in relation to 240) for F. Accordingly, the lifetime gifts from A are reduced by 10 (1/6 of 60), from B by 5 (1/12 of 60), for C by 15 (25% of 60) and for F by 30 (50% of 60). As a result, A receives 150, B 135, C 465, D 120, and F 90.

Bibliography

Baumann Lorenz, Vergleichsvereinbarungen und ihre Risiken bei der Erbschaftssteuer, BGer 2C_550/2019, successio 2 (2022), S. 146-153 (zit. Baumann).

Eggel Martin/Gerster Nathalie, Revision des Erbrechts – Behandlung der Säule 3a und Änderungen im Herabsetzungsrecht, in: Wolf Stephan (Hrsg.), Das neue Erbrecht – insbesondere Rechtsgeschäftsplanung, Fragen aus der notariellen Praxis und internationales Erbrecht, Schriften INR, Band 27, Bern 2022 (zit. Eggel/Gerster).

Eitel Paul/Bieri Marjolein, Die Durchführung der Herabsetzung bei Schenkungen, Lebensversicherungen und Trusts, successio 4 (2015), S. 288-303 (zit. Eitel/Bieri).

Eitel Paul, Zur Durchführung der Herabsetzung bei ehevertraglichen Totalvorschlagszuweisungen und Erwerbungen gemäss der gesetzlichen Erbfolge im neuen Erbrecht, in: Verband Solothurnischer Notare (Hrsg.), 100 Jahre Festschrift, Solothurn 2022, S. 97-118 (zit. Eitel).

Escher Arnold, Zürcher Kommentar - Kommentar zum Schweizerischen Zivilgesetzbuch, Erbrecht (Art. 457-536 ZGB), Band III 1/2, 3. Aufl., Zürich 1959 (zit. ZK-Escher).

Fankhauser Roland, Kommentierung zu Art. 523 ZGB, in: Ruth Arnet/Breitschmid Peter/Jungo Alexandra (Hrsg.), Handkommentar zum Schweizer Privatrecht, Band 2, 4. Aufl., Zürich 2023 (zit. CHK-Fankhauser, Art. 523 ZGB).

Henninger Julia, Die Pflichtteilsproblematik bei der Unternehmensnachfolge, Zürich/Basel/Genf 2019 (zit. Henninger).

Hrubesch-Millauer Stephanie, Kommentierung zu Art. 523 ZGB, in: Abt Daniel/Weibel Thomas (Hrsg.), Praxiskommentar Erbrecht, 5. Aufl., Basel 2023 (zit. Hrubesch-Millauer, PraKomm, Art. 523 ZGB).

Hrubesch-Millauer Stephanie, Kommentierung zu Art. 525 ZGB, in: Abt Daniel/Weibel Thomas (Hrsg.), Praxiskommentar Erbrecht, 5. Aufl., Basel 2023 (zit. Hrubesch-Millauer, PraKomm, Art. 525 ZGB).

Hrubesch-Millauer Stephanie, Kommentierung zu Art. 532 ZGB, in: Abt Daniel/Weibel Thomas (Hrsg.), Praxiskommentar Erbrecht, 5. Aufl., Basel 2023 (zit. Hrubesch-Millauer, PraKomm, Art. 532 ZGB).

Kuster Mathias, Anhang Checkliste, Systematische Übersicht über materielle und formelle Verfügungen von Todes wegen, in: Abt Daniel/Weibel Thomas (Hrsg.), Praxiskommentar Erbrecht, 5. Aufl., Basel 2023 (zit. Kuster, PraKomm, Checkliste).

Jungo Alexandra, Die ehevertraglich begünstigte Ehegattin zwischen Pflichtteilsansprüchen gemeinsamer und nichtgemeinsamer Kinder, in: Jörg Schmid/Regina Aebi-Müller/Peter Breitschmid/Barbara Graham-Siegenthaler/Alexandra Jungo (Hrsg.), Spuren im Erbrecht, Festschrift für Paul Eitel, Zürich/Genf 2022, S. 371-390 (zit. Jungo, Ehegattin).

Jungo Alexandra, Pflichtteile bei voller Vorschlagszuweisung – die Klärung durch die Erbrechtsrevision, in: Peter Breitschmid/Paul Eitel/Alexandra Jungo (Hrsg.), Der letzte Wille, seine Vollstreckung und seine Vollstrecker, Festschrift für Hans Rainer Künzle, successio-Schriften Nr. 4, Zürich/Basel/Genf 2021, S. 193-217 (zit. Jungo, Pflichtteile).

Jungo Alexandra, Tafeln und Fälle zum Erbrecht, 4. Aufl., Zürich/Basel/Genf 2017 (zit. Jungo, Tafeln).

Möri Nathalie, Durchführung der Herabsetzung nach Art. 532 ZGB, insbesondere bei gewöhnlichen Schenkungen, Schenkungsversprechen und frei widerruflichen Schenkungen, AJP 6 (2016), S. 803-814 (zit. Möri).

Piatti Giorgio, Kommentierung zu Art. 523 ZGB, in: Geiser Thomas/Wolf Stephan (Hrsg.), Basler Kommentar, Zivilgesetzbuch II, 7. Aufl., Basel 2023 (zit. BSK-Piatti, Art. 523 ZGB).

Piatti Giorgio, Kommentierung zu Art. 532 ZGB, in: Geiser Thomas/Wolf Stephan (Hrsg.), Basler Kommentar, Zivilgesetzbuch II, 7. Aufl., Basel 2023 (zit. BSK-Piatti, Art. 532 ZGB).

Wolf Stephan/Genna Gian Sandro, Schweizerisches Privatrecht, Erbrecht, Band IV/1, Basel 2012 (zit. Wolf/Genna).

Zeiter Alexandra, Die Herabsetzung des Intestaterwerbs, in: Jörg Schmid/Regina Aebi-Müller/Peter Breitschmid/Barbara Graham-Siegenthaler/Alexandra Jungo (Hrsg.), Spuren im Erbrecht, Festschrift für Paul Eitel, Zürich/Genf 2022, S. 655-675 (zit. Zeiter).

Materials

Botschaft des Bundesrates an die Bundesversammlung zu einem Gesetzesentwurf enthaltend das Schweizerische Zivilgesetzbuch vom 28.5.1904, BBl 1904 IV 1 ff., abrufbar unter https://www.fedlex.admin.ch/eli/fga/1904/4_1_1_/de, besucht am 5.5.2025 (zit. Botschaft 1904).

Botschaft zur Änderung des Schweizerischen Zivilgesetzbuches (Erbrecht) vom 29.8.2018, BBl 2018 5813 ff., abrufbar unter https://www.fedlex.admin.ch/eli/fga/2018/2131/de, besucht am 5.5.2025 (zit. Botschaft 2018).